Content

By doing so, your financial guidance will never be stored in your mobile device. In some instances, a mobile deposit can take extended in order to process and require a great hold. SmartBank tend to email address you to definitely tell you whenever we you need to hold a mobile put and can include information on when you should predict the amount of money getting available. And, non-analyzed team account are eligible to utilize mobile deposit. Pursuing the teller have processed your look at, they will provide a bill summarizing the order and cash if you expected they. Remark the new receipt cautiously to ensure the facts is actually right and you can number hardly any money given.

Reddit best online casino – What are the limits away from mobile consider deposits?

After you’ve verified what you appears proper, faucet “Submit” or the same option in the application to help you complete your own put. The lending company’s system validates the newest consider from the guaranteeing navigation and reddit best online casino account number, examining to have copies, and you will examining display quality. Inaccuracies will get punctual guidelines comment, the spot where the lender evaluates the new put contrary to the member’s account history to possess irregularities.

- A little a comparable fee algorithm is used various other banking tips through devices, for example Siru mobile fee, Boku or PayforIt.

- You could have the option to pay a fee for the money to be offered an identical and/or next day.

- This particular aspect limits the total amount your’re also in a position to put on the smart phone for each and every working day.

- Mobile put is very easier if you would like put a good view immediately after business hours, on the a financial vacation, if you don’t more than a week-end.

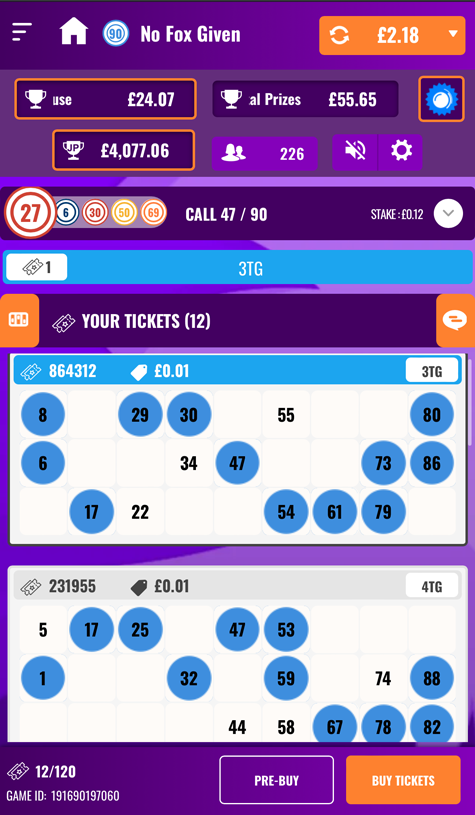

- Sure, your mobile put constraints receive for each and every qualified membership whenever you select in initial deposit to account as well as on the newest Enter into Count display screen.

Even when their mobile put seems to come off rather than a good hitch, it does remain a smart idea to hold on to the fresh paper consider once it clears, and if there’s a problem after. Cellular take a look at deposit is a mobile financial unit enabling your to deposit monitors to the bank account making use of your smart phone. Basically, shell out because of the mobile gambling enterprises provide a fast, safe, and you will associate-friendly way to put financing utilizing your smartphone costs otherwise prepaid service balance. Having a wide selection of online game, bonuses, as well as the power to manage your bankroll easily, cell phone costs gambling enterprises are extremely a leading selection for of a lot on the web gambling establishment followers. Because of the leveraging mobile asking functions, participants can also enjoy instant deposits without the need to express painful and sensitive banking suggestions, making sure each other convenience and you will comfort.

You might be informed of your limits once you you will need to build in initial deposit. Once you have hit your limit, you would not be able to make various other deposit through to the next day or week. Cellular view deposit is here now to remain, and its own future appears encouraging.

Cellular payments have been in anyone domain name while the 90s, when the likes from Sony Ericsson and you can Coca cola tried to find goods thru Texts. Intentionally placing a similar cheque over and over again is considered ripoff. Ripoff is actually a significant criminal offense which is punishable because of the a great jail sentence.

Need the HSBC Mobile Banking software?

When you’ve completed and then make the deposit, hold on to their take a look at until the complete amount features removed your account. Their lender will get suggest that you keep their seek out an excellent particular period, such five so you can 7 days. After the take a look at has cleaned and also you feel at ease taking care of the take a look at, shred they or destroy they properly. Look at the software’s mobile look at put guidelines to be sure you’re also composing a proper statement ahead of continuing.

If you have a hang on your account for any reason, you might not be able to deposit a with the mobile app. Make an effort to get hold of your lender to answer the brand new keep prior to making a deposit. Once deposit a by using the mobile app, it’s vital that you securely store the brand new actual seek out a number of days in case there is any complications with the newest deposit. You will need to wait until the new day on the view before deposit it. – Lender A have a cellular put restrict out of $dos,500 each day and you will $5,000 for each 30-go out several months.

Here’s a listing of the fresh cellular consider deposit limits from the biggest banking institutions that you can resource. Should you ever need to source the pictures you grabbed of the cellular view put, the financial may offer the option to consider them whenever your access the declaration. Really cellular banking applications do not let one to store photos of your own monitors you deposit in your cell phone. Which have a cellular financial app, you could take control of your cash from your own cellular phone without having to take a seat during the a computer or visit a branch of your own lender. It’s much more an easy task to completely digitize your financial life, counting on credit and you may debit notes to have sales, playing with applications to send money for the loved ones, and you may paying debts on the web. Cellular view put, also called mobile put, makes you put paper inspections into the savings account having fun with a cellular software on your own smartphone.

That have cellular view deposit, you could put a check via your smartphone or tablet, plus the techniques just requires a minute or two. To put it differently, you don’t have to use some time and gasoline money to visit a bank part or Automatic teller machine, and you also wear’t need to worry about . If the current membership doesn’t render this particular aspect, it could be value contrasting examining account to get the one that has mobile look at deposit or any other useful digital banking has.

Payment make a difference the location and acquisition where including businesses show up on this page. All the including location, order and you can business reviews try at the mercy of alter based on editorial behavior. Mobile View Deposit allows you to put their checks as opposed to an excellent visit to the bank. Utilize the Citi Mobile financial App in order to put your following take a look at along with your mobile.

Most of the time, the new transferred money are available to the day pursuing the put is credited. But not, only a few membership meet the requirements to possess mobile deposits, there is limits about how much currency will be placed this way. The brand new cellular put element was designed to getting affiliate-amicable and secure.

Digital banking means all of the relations from financial with technology. That means that digital financial includes things like on the internet banking away from your desktop plus the on the web features one to financial institutions render, such payroll equipment and online transmits. Chase’s site and you may/otherwise cellular words, privacy and you may protection formula do not connect with the site otherwise app you are planning to see. Delight review the conditions, confidentiality and shelter regulations observe how they apply at your. Chase isn’t guilty of (and cannot give) any things, services or articles at that third-people site or app, apart from products and services you to definitely explicitly hold the newest Pursue name. With Pursue for Team your’ll receive suggestions of a group of team experts who specialise in assisting improve cashflow, getting credit choices, and you can controlling payroll.

Luckily, for individuals who lender with a lending institution who has a mobile application, you do not need to visit a branch to help you deposit a great look at. Rather, it’s likely it is possible to put a check at any place using only the mobile phone. Mobile consider put are a quick, easier means to fix put financing with your mobile device.

If you make mistakes when promoting a check otherwise taking pictures of one’s view, it may cause your financial establishment so you can deny your consider. You might have to waiting to work out people points or sense a delay in enabling your fund. Taking such actions can also be finest cover your finances and personal suggestions when using the device to help you deposit checks or complete most other banking work.