- Are all cryptocurrencies the same

- Do all cryptocurrencies use blockchain

- Why do all cryptocurrencies rise and fall together

Are all cryptocurrencies based on blockchain

When it comes to crypto casino game selection, cryptocurrency casinos are not that different from regular casinos. The number and types of casino games offered by Bitcoin and other crypto casinos, of course, differ greatly from casino to casino https://ripworkoutsale.com.

It’s a bit funny to think that while once people reacted to it the same way that they react to Bitcoin now (claiming it’s not “real money” if it’s not cash or in a bank), today, millions of people use this payment method for both online gambling and regular, everyday shopping!

Crypto casinos are a relatively new phenomenon. The first cryptocurrency casino sites appeared at the beginning of 2010s and since then, their popularity has gradually increased. Today, a lot of players opt for crypto casinos, which have become an integral part of online gambling.

These are just three examples. Each casino deals with this in a specific way, so make sure to do the research and find out how crypto deposit and withdrawals are handled before choosing the best casino to play in. This information is not always listed on the website, but you should get to them by contacting the casino’s customer support.

Are all cryptocurrencies the same

We all want immediate transactions, but it’s not possible every time. For example, when it comes to Bitcoins, if you trade them, they will be available at the very same moment. The same goes for sending them to your friends. But, for those who are mining through their super-powerful computers, it’s not that easy. They may need to wait for a little until the transaction is completed, and that can be a little frustrating. In the blockchain, there are just 7 transactions per second, and compared to the other currencies, that’s far less than 20, 50, or even 2000 transactions per second. But, on the other hand, you should be aware that Bitcoin money transfer is covered with a few layers of protection and encryption, and that’s why it may be much slower than the other currencies.

Investing in cryptocurrencies is a little different than investing in shares of a company. Stock represents ownership of a business and a claim to profits the company generates. Purchasing coins of a cryptocurrency, though, is a speculative bet on the price movement of that digital currency — which can be highly volatile and is subject to the law of supply and demand since digital currency by itself is not a dynamic asset. Cryptocurrencies can be exchanged for other digital currencies or for fiat currencies like the U.S. dollar using a digital wallet on a trading app.

Many companies have tried to reduce volatility by introducing stablecoins, whose value is fixed to the price of fiat currency. This is usually done by depositing an equivalent amount of fiat, which can be used to redeem the tokens. However, stablecoin issuers such as Tether have used these deposits on more speculative investments, raising concerns that they are vulnerable to a market crash.

We all want immediate transactions, but it’s not possible every time. For example, when it comes to Bitcoins, if you trade them, they will be available at the very same moment. The same goes for sending them to your friends. But, for those who are mining through their super-powerful computers, it’s not that easy. They may need to wait for a little until the transaction is completed, and that can be a little frustrating. In the blockchain, there are just 7 transactions per second, and compared to the other currencies, that’s far less than 20, 50, or even 2000 transactions per second. But, on the other hand, you should be aware that Bitcoin money transfer is covered with a few layers of protection and encryption, and that’s why it may be much slower than the other currencies.

Investing in cryptocurrencies is a little different than investing in shares of a company. Stock represents ownership of a business and a claim to profits the company generates. Purchasing coins of a cryptocurrency, though, is a speculative bet on the price movement of that digital currency — which can be highly volatile and is subject to the law of supply and demand since digital currency by itself is not a dynamic asset. Cryptocurrencies can be exchanged for other digital currencies or for fiat currencies like the U.S. dollar using a digital wallet on a trading app.

Many companies have tried to reduce volatility by introducing stablecoins, whose value is fixed to the price of fiat currency. This is usually done by depositing an equivalent amount of fiat, which can be used to redeem the tokens. However, stablecoin issuers such as Tether have used these deposits on more speculative investments, raising concerns that they are vulnerable to a market crash.

Do all cryptocurrencies use blockchain

Introduction: My name is Greg Kuvalis, I am a witty, spotless, beautiful, charming, delightful, thankful, beautiful person who loves writing and wants to share my knowledge and understanding with you.

Users are encouraged to “stake” their coins, acting like mini-bankers who validate transactions. This not only secures the network but also earns them more coins. It’s like a virtuous cycle of earning while securing.

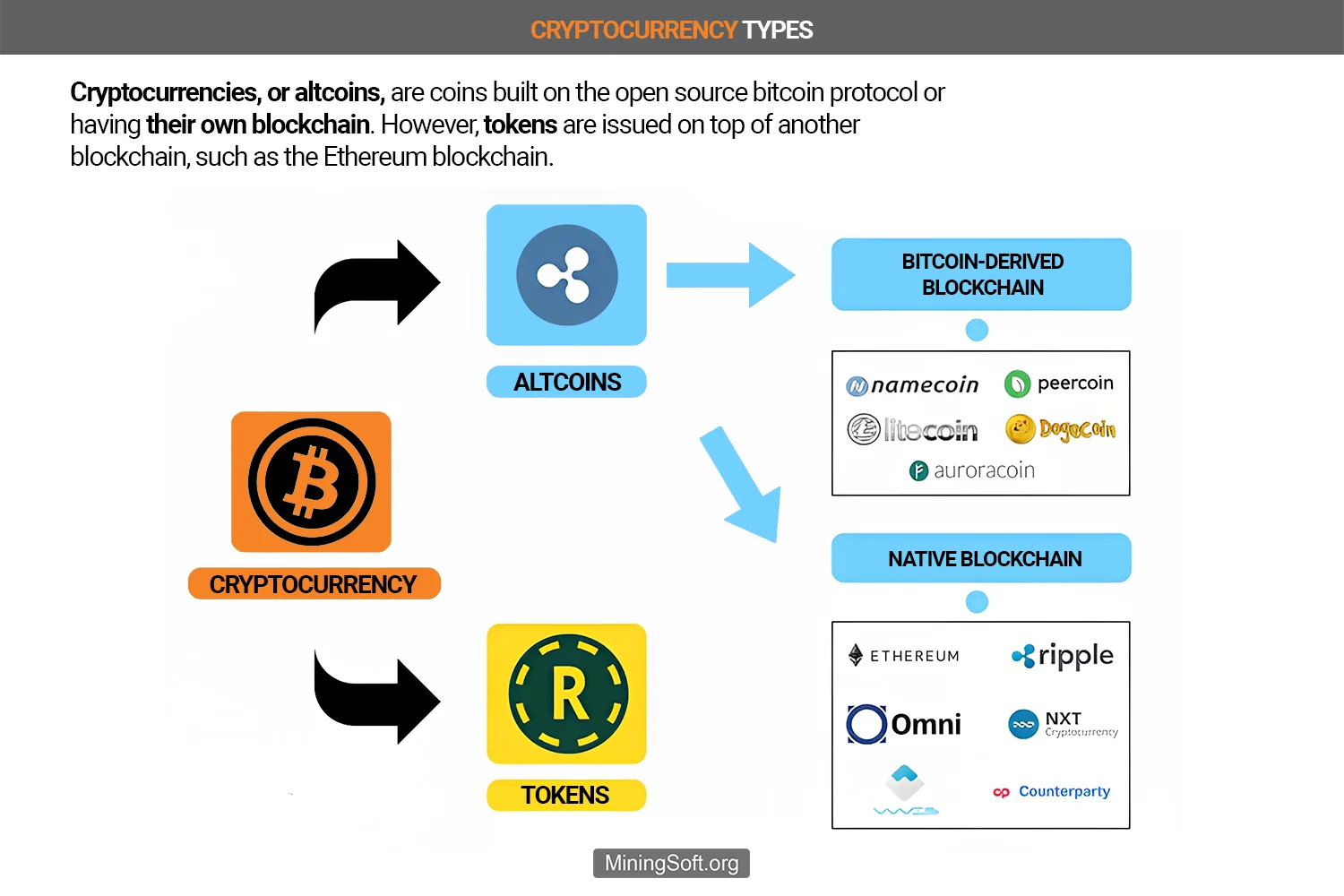

Tokens are your VIP passes to specific blockchain projects or DApps. They often need another blockchain, like Ethereum, to operate. Coins, however, are the sovereign rulers of their own blockchain kingdoms, like Bitcoin and Ether.

Why do all cryptocurrencies rise and fall together

Cryptocurrency markets are sensitive to regulatory actions taken by governments and financial institutions worldwide. Regulatory uncertainty or unfavourable regulations can dampen investor sentiment and trigger sell-offs. Similarly, clear regulatory frameworks that provide legitimacy and investor protection can boost confidence and attract institutional investors. China’s crackdown on cryptocurrency mining in 2021 sent shockwaves through the market, leading to a significant drop in Bitcoin’s price.

Security breaches can shake investor confidence and cause significant price fluctuations in the cryptocurrency market. When hackers exploit vulnerabilities in blockchain networks or cryptocurrency exchanges, panic often sets in. Investors rush to sell their holdings, leading to sharp declines in price. For example, high-profile breaches like the Mt. Gox hack in 2014 resulted in bitcoin losing over 50% of its value within weeks.

These psychological factors contribute to market volatility. Investors who act impulsively often face negative outcomes, especially during periods of extreme price fluctuations. Understanding these dynamics can help investors make more informed decisions and avoid falling victim to emotional trading.

Forks can also lead to uncertainty. When a blockchain splits into two versions, investors may hesitate, unsure of which version will gain traction. Bitcoin Cash, created from a bitcoin fork in 2017, saw initial volatility before stabilizing. Upcoming upgrades, like the Chang Hard Fork expected in 2024, are predicted to spark bullish trends based on historical patterns. These events demonstrate how technological changes can influence cryptocurrency prices both positively and negatively.

Projects with a high percentage of their total supply already in circulation often show more stable price movements. For example, cryptocurrencies with over 80% of their supply in circulation tend to experience less volatility. However, projects with less than 50% of their supply in circulation can pose risks of dilution, which may negatively impact their value. Understanding these supply metrics is crucial for investors navigating the cryptocurrency market.